Today's National Living Wage rise to £10.42 per hour will be a welcome boost for many low paid workers, but over 12,000 businesses already pay the higher real Living Wage.

-

National Living Wage rises today (April 1st 2023) but 12,000 employers across the UK already choose to pay a higher, real Living Wage set by the Living Wage Foundation.

-

Workers paid the National Living Wage would need an extra £936 per year to bring earnings in line with the real Living Wage. The difference could pay for 14 weeks of food, or 11 weeks of housing and energy costs.

-

Workers in London paid the National Living Wage need £2,983.50 extra per year to bring earnings in line with the London Living Wage. The difference could pay for 38 weeks of food bills, or 21 weeks of housing and energy costs.

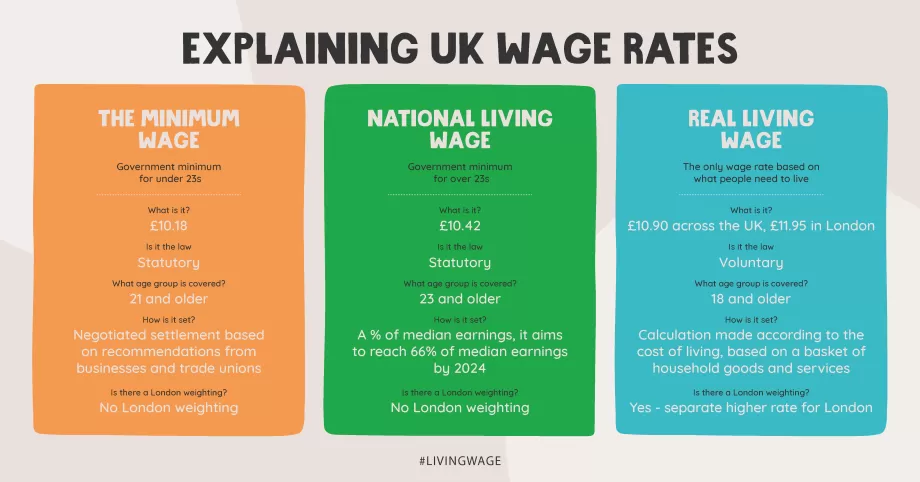

The legal minimum wage for over 23s (the National Living Wage) will rise tomorrow, but 12,000 employers across the UK – including Burberry, IKEA, Everton FC, Aviva and thousands of small-to-medium-sized businesses – already voluntarily go above the Government’s National Living Wage and pay all staff the real Living Wage. The real Living Wage, set by the Living Wage Foundation and based on the true cost of living, is £10.90 in the UK, and £11.95 in London.

A UK worker earning the National Living Wage would need an extra £936 each year to bring their income in line with the real Living Wage. This difference amounts to over 3 months of food bills (14 weeks) or 11 weeks of housing and energy costs, according to national averages.

With the cost of living in the capital higher than the rest of the UK, a worker living in London and being paid the government’s National Living Wage would need to find £2,983.50 extra to bring their earnings in line with the London Living Wage. This difference represents over 9 months of food bills (38 weeks), or over 5 months of housing and energy costs (21 weeks).

The Living Wage rates are the only wage rates independently calculated according to the cost of living in London and the UK, and over 12,000 UK employers have signed up to pay these higher rates. It applies to everyone over the age of 18. The real Living Wage rates increase annually and are set to go up in the Autumn. There are currently 3.5 million jobs below the real Living Wage in the UK (1 in 8 jobs).

Alongside paying a real Living Wage, employers can also provide workers with stability and security in their working hours and in their retirement through the Living Wage Foundation’s complementary Living Hours and Living Pension programmes.

Katherine Chapman, Director of the Living Wage Foundation, said:

“This significant rise in the National Living Wage is a welcome boost to ease some of the pressure inflation continues to pile onto low-paid workers. It remains lower than the real Living Wage which is based on the cost of living – the good news is we have seen record numbers of employers signing up to pay the higher real Living Wage to protect their lowest paid staff during these tough times.

There are now over 12,500 Living Wage Employers across the UK who not only provide stability and certainty to their employees but also helping move us to a high-wage, high-growth economy as decently paid employees are likely to be more committed, productive and spend more in their local economies. The Living Wage is good for people and business and we encourage those organisations who can, to make the Living Wage commitment too"

Kai, who earns the real Living Wage at Yes Manchester, said:

“I always wanted to do well for myself but didn’t get the support I could’ve done at school and came out with no GCSEs. I went between agency jobs that were low paid and had no guaranteed hours of work, which kept me going back to the job centre and universal credit because I couldn’t rely on my income. Being paid the real Living Wage has massively helped me. I’ve been able to move out of my mother’s house and in with a friend. Coming to somewhere I’m paid a decent wage and feel appreciated makes me work 110% harder.”

Chloe, sales assistant at LUSH, said:

“I have worked for LUSH and earned the real living wage for almost 6 years, since the age of 16. The extra income has allowed me to afford things that others my age have struggled to, including buying a car and moving out of my parents house. Earning the real living wage has also allowed me to go to university and live comfortably while training to be a paramedic. It’s vital that people are paid in line with the cost of living, so that they can live comfortably without worries.”

Adam Green, CEO of Yes Manchester, said:

'Yes Manchester is a charity that exists to support those that are unemployed or under-employed; we therefore understand and appreciate the challenges faced when receiving a lower income.

One of the ways in which we demonstrate and live by our values is by ensuring that all staff will receive at least the real Living Wage. The decision to pay the real Living Wage represents Yes Manchester’s commitment to delivering more than the minimum and ensuring the best possible experience and outcomes for our customers and partners in the community. Paying the real Living Wage is quite simply the right thing to do.’’

Media Contact

Emily Roe: emily.roe@livingwage.org.uk / 07581 430557

Klervi Mignon: klervi.mignon@livingwage.org.uk / 07939 342573

What is the real Living Wage?

The real Living Wage is an hourly rate of pay set independently and updated annually (not the UK government’s National Living Wage). It is calculated according to the basic cost of living in the UK, and employers choose to pay the Living Wage on a voluntary basis. According to the Living Wage Foundation, since 2011 the campaign has impacted nearly450,000 employees and delivered over £2bn extra to some of the lowest paid workers in the UK.

About the Living Wage Foundation

The Living Wage Foundation is the institution at the heart of the independent movement of businesses, organisations and people who believe that a hard day’s work should mean a fair day’s pay. We recognise and celebrate the leadership shown by the over 12,000 Living Wage Employers across the UK who voluntarily commit to ensure their staff earn a real Living Wage that meets the cost of living. We are an initiative of Citizens UK.

Only the real Living Wage is calculated according to the cost of living in the UK and in London. Employers choose to pay this wage on a voluntary basis. The real Living Wage applies to all workers over 18 – in recognition that young people face the same living costs as everyone else. It enjoys cross party support.

The UK Living Wage for outside of London is £10.90 per hour. The London Living Wage is £11.95 per hour. These figures are calculated annually by the Resolution Foundation and overseen by the Living Wage Commission, based on the best available evidence on living standards in the UK and in London.

The Living Wage Foundation has also developed complementary schemes for employers who want to tackle insecurity of hours - Living Hours – and poverty in retirement – the Living Pension – alongside paying a real Living Wage. Over 60 employers now provide their workers with stability and security of hours, and the Living Pension launched in March 2023 with 6 employers committed to meeting an annual savings target which aims to help workers build a pension pot that will meet everyday needs in retirement.

What about the Government’s national living wage?

In July 2015 the Chancellor of the Exchequer announced that the UK Government would introduce a compulsory ‘national living wage’ (NLW). This new government rate was a new minimum wage for staff over 25 years old. It was introduced in April 2016 and the rate is £9.50 per hour as of April 2022, rising to £10.42 in April this year. From April 2021 it applies to everyone over 23 years old.

The rate is different to the Living Wage rates calculated by the Living Wage Foundation. The government rate is based on median earnings, while the Living Wage Foundation rates remain the only ones calculated according to the cost of living in London and the UK.